Verify Every Participant.

Document Every Meeting.

Real-time identity verification for video calls, interviews, and high-stakes decisions.

Deepfakes and impersonation are reshaping fraud. Polyguard is your front line of defense: biometric certainty in a world of synthetic lies.

Ensure participant identity certainty in your most important Zoom meetings - from remote job interviews to board discussions - with automated verification and compliance reporting.

“Unlike conventional detection solutions, Polyguard aims to intercept threats before they are transmitted...”

Tony Bradley, Forbes

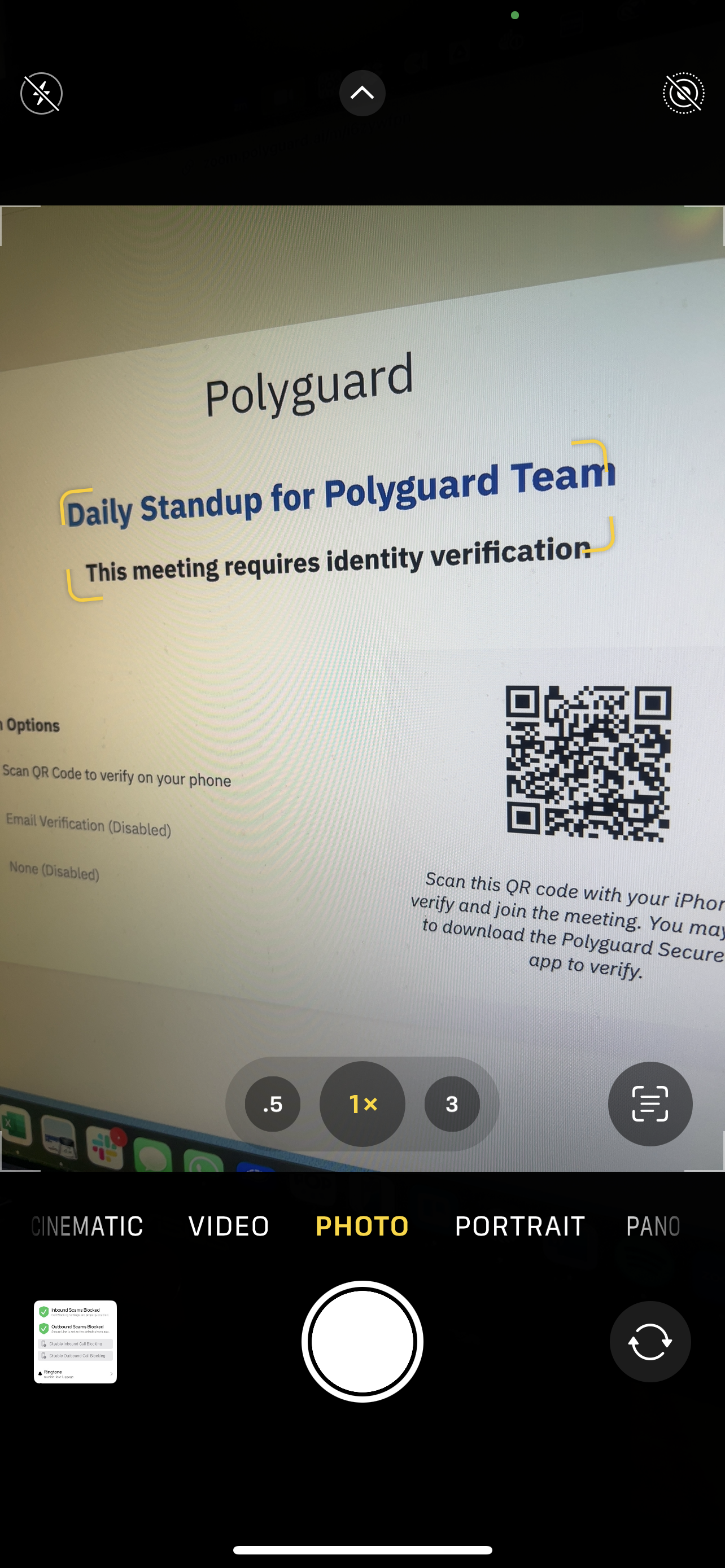

How the Polyguard System works

Simple for users. Powerful for HR & IT.

Invite participants to a Polyguard-verified meeting.

They prove their identity on mobile (biometrics + ID).

You get certainty: live badge, meeting logs, and records.

Everything you might need…

Set required proofs for each meeting.

Add location or employment requirements.

Guarantee continuity from one meeting to the next.

…and nothing you don’t want

Avoid capturing personally-identifiable information or sensitive data

No more drivers license or passport photos accidentally stored in the meeting recordings

Participant Certainty

Real-time biometric verification

Government ID validation

Eliminates interview fraud and meeting uncertainty

Automated Compliance

Meeting verification reports

Audit trail generation

Regulatory requirement fulfillment

Seamless Integration

Works with existing Zoom workflows

Setup in under 5 minutes

Participant app is freely downloadable

Use Case Scenarios

Remote Hiring

Verify candidate identity during virtual interviews

Benefits

Live facial biometric verification with liveness detection

Government-issued ID proofing and phone number attestation

Immutable audit logs of every interview interaction

Compliance Advantages

Avoid OFAC and AML violations from sanctioned or misrepresented applicants

Meet GDPR and EEOC requirements for lawful data handling and identity transparency

Support fair hiring practices with documented identity proof

Risk Mitigation

Prevent "North Korean" and deepfake candidate scams

Detect proxy interview fraud or impersonation schemes

Restore trust in global and remote-first recruiting

Board Meetings

Ensure only staff and authorized directors participate

Benefits

One-click biometric verification before joining confidential sessions

Real-time alerts for unverified participants or attempted access

Tamper-proof attendance certificates

Compliance Advantages

Satisfies governance and auditing standards for restricted meetings

Enables secure remote voting and decision-making

Prevents unauthorized disclosures under Sarbanes-Oxley

Risk Mitigation

Stop insider leaks or rogue access via compromised invites

Mitigate legal liability from improper quorum validation

Protect sensitive strategy and leadership conversations

Perspectives:

The Polyguard blog

David Marshall, VMBlog